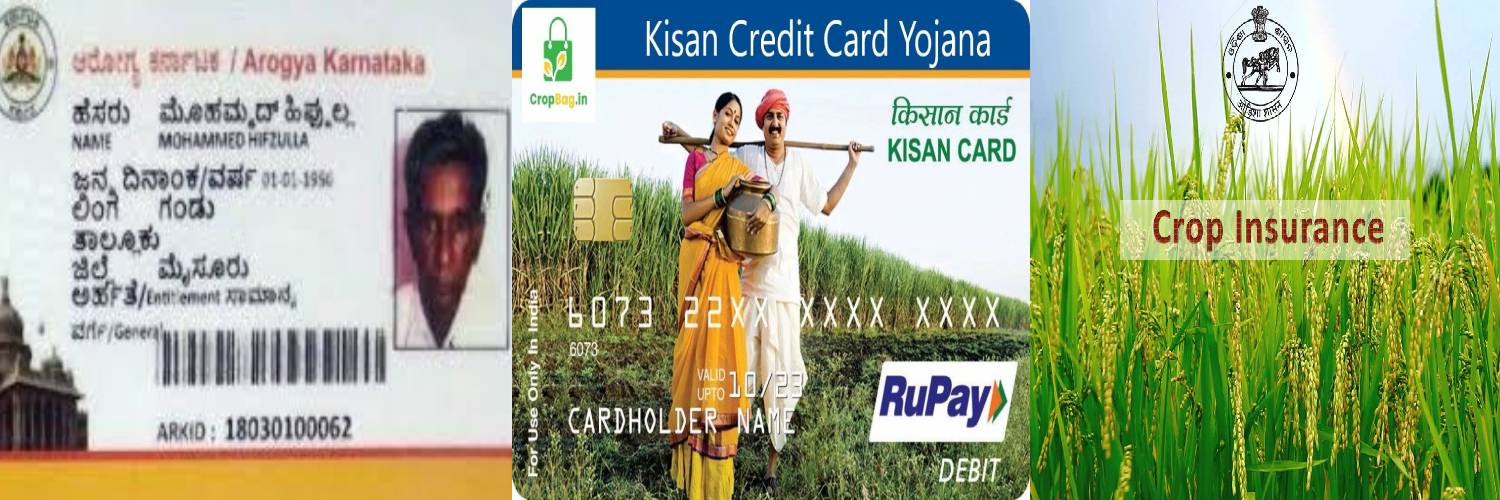

Our team will go to the villages where the farmers will be provided with Ayushman Health Card, Kisan Credit Card and Crop Insurance Scheme.

Ayushman Health Card (Deshbandhu Trust Team providing Ayushman Health Card for the farmers to get all the benefits from the goverment)

- It is one of the world’s largest health insurance schemes financed by the government of India.

- Coverage of Rs.5 lakh per family per annum for secondary and tertiary care across public and private hospitals.

- Approximately 50 crore beneficiaries (over 10 crore poor and vulnerable entitled families) are eligible for the scheme.

- Cashless hospitalisation.

- Covers up to 3 days of pre-hospitalisation expenses such as medicines and diagnostics. Covers up to 15 days of post-hospitalisation expenses which include medicines and diagnostics.

- No restriction on the family size, gender or age.

- Can avail services across the country at any of the empanelled public and private hospitals.

- All pre-existing conditions covered from day one.

- The scheme includes 1,393 medical procedures.

- Includes costs for diagnostic services, drugs, room charges, physician’s fees, surgeon charges, supplies, ICU and OT charges.

- Public hospitals are reimbursed at par with private hospitals.

Kisan Credit Card (Deshbandhu Trust Team providing Kisan Credit Card for the farmers to get all the benefits from the goverment)

- Farmers are given credit for meeting their financial requirements of agricultural and other allied activities along with post-harvest expenses.

- Investment credit for agricultural requirements such as dairy animals, pump sets etc.

- Farmers can take out a loan of up to Rs.3 lakh and also avail produce marketing loans.

- Insurance coverage for KCC scheme holders up to Rs.50,000 in the case of permanent disability or death. A cover of Rs.25,000 is given in the case of other risks.

- Eligible farmers will be issued a savings account with attractive interest rate along with smart card and a debit card in addition to the Kisan Credit Card.

- Flexible repayment options and hassle-free disbursement procedure.

- Single credit facility/ term loan for all agricultural and ancillary requirements.

- Assistance in the purchase of fertilizers, seeds, etc. as well as in availing cash discounts from merchants/ dealers.

- Credit is available for a period of up to 3 years and repayment can be made once the harvest season in over.

- No collateral will be required for loans amounting up to Rs.1.60 lakh.

Crop Insurance Scheme (Deshbandhu Trust Team providing Crop Insurance Scheme for the farmers to get all the benefits from the goverment)

- Provides financial support to farmers thus, covers crop loss and damage arising out of unforeseen events.

- Tax exemption on the premium paid by the farmers against the purchase of the crop insurance policy.

- Farmers would get peace of mind as they don’t need to take loans from private lenders at higher interest rates.

- Encourages farmers to adopt modern and innovative agriculture practices that further increase their personal income.

- Economy of the country will get strengthened as farmers can repay loans with the reimbursement received from the crop insurance.